Scam Bankrun Fraud: The Collapse Of A Crypto Empire

(All views expressed below are the personal views of the author. We do know that a lot of the information is unconfirmed, but we are solely forming and sharing our opinions based on data and information that is publicly available)

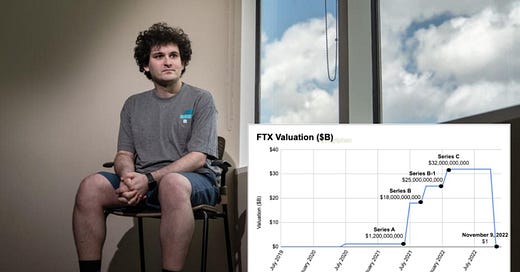

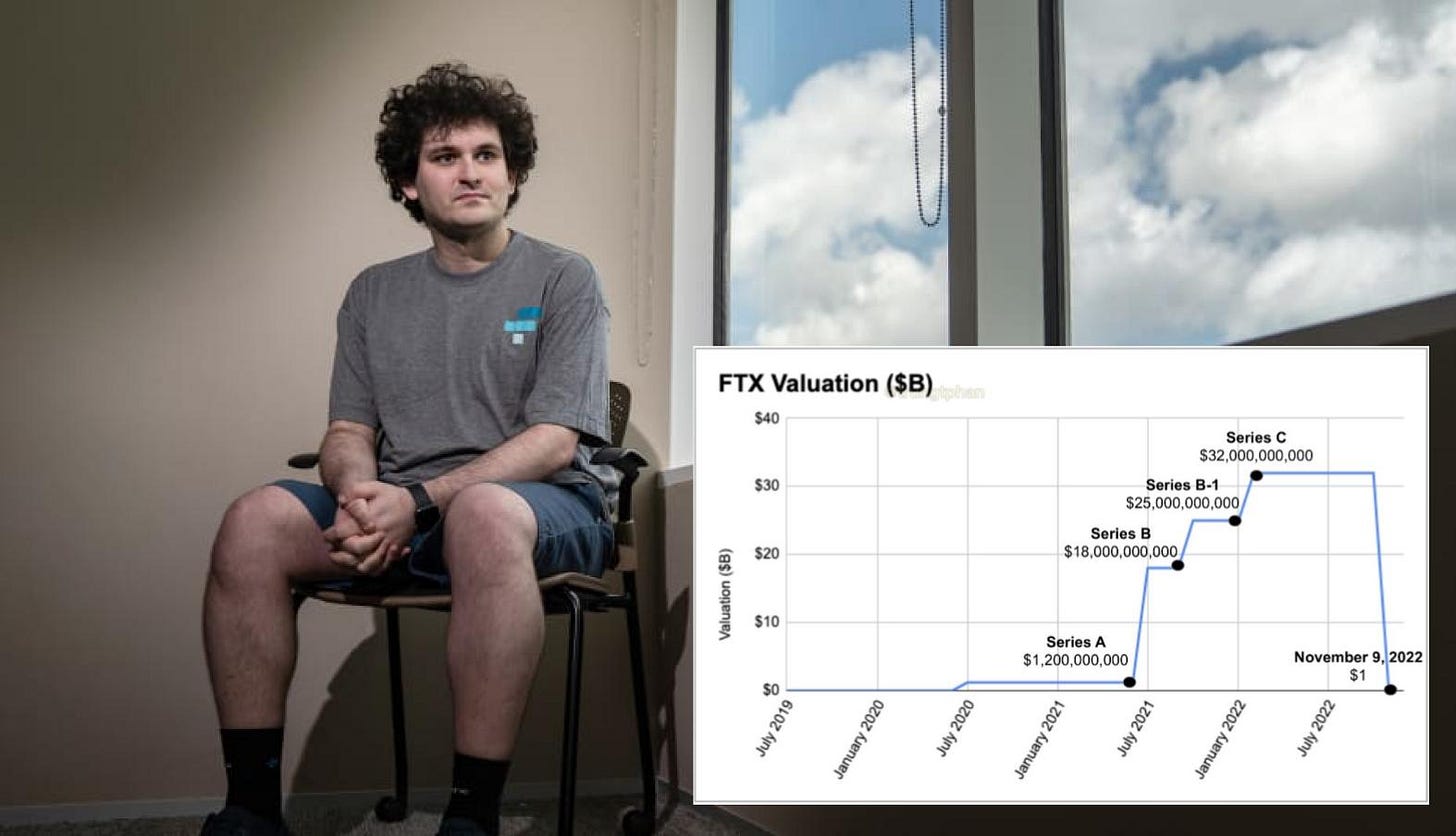

On August 24th, news broke that Sam Trabucco stepped down as Co-CEO of Alameda Research. One month later, Brett Harrison announces his decision to step down from his role of President at FTX US. Coincidence? Well, maybe, but we had an inkling that something was happening behind the scenes at FTX and decided to withdraw our funds from the exchange. After witnessing what happened to Three Arrows Capital back in June, we were not willing to take any chances with our funds; the bear market had robbed us enough. Fast forward to 3 months after Trabucco’s departure, Sam Bankman-Fried’s empire collapses. On Friday November 11th, FTX, FTX US, and Alameda Research filed for Chapter 11 Bankruptcy. FTX went from being a top 3 centralized exchange that did $21 billion trading volume and generated $1 billion in revenue (at its peak in 2021), to declaring bankruptcy. Alameda went from having a peak AUM of $15 billion to digging themselves into a financial hole amounting to $8-$10 billion. If you’re looking for a simple explanation of the collapse of FTX and Alameda – continue reading as we share what we know so far, as well as our thoughts surrounding the collapse and where we feel the crypto industry is headed. For those who are interested, we’ll also include additional content that is relevant to this saga at the bottom of this article.

Scam

When Coindesk leaked Alameda Research’s balance sheet, it revealed that they had assets amounting to $14.6 billion. Of that $14.6 billion, $3.6 billion of it was the FTT token and $2.1 billion of FTT collateral. This was an immediate red flag, as Alameda’s assets largely comprised of FTX’s own token — FTT. Alameda’s largest asset was essentially a token printed by their sister-company with its value largely held up by hot air (Alameda and FTX were both founded by Sam Bankman-Fried). Their other assets were made up of many Solana and Solana ecosystem coins, of which many were illiquid. Naturally, this started to raise alarm bells all over Twitter. After this revelation, Binance CEO CZ then tweeted that Binance was selling their investment stake in FTT for “risk management purposes” (Many speculated that it’s because CZ and SBF have beef, more on this here). This caused panic to set in for investors as the price of FTT started to tank. As the price of FTT started spiraling down, investors started to withdraw their funds from FTX – a bank run was on our hands.

Bankrun

As the FTX bank run began, SBF decided to put together a string of tweets (that are now deleted) that said - “FTX is fine. Assets are fine” and “ FTX has enough to cover all client holdings. We don’t invest client assets”.

Figure 1: SBF tweets “Assets are fine”

You could tell that this was a clear attempt by SBF to try and minimize the chaos, but it was a little too late as a lot of the sentiment around the situation still remained negative. Sell pressure on FTT continued to pile in, which caused the price of FTT to drop ~30% within the span of a few hours.

Figure 2: FTT Token Price

As withdrawal requests continued piling in, on-chain data then showed that USDC withdrawals were stuck due to low reserves.

Soon after that, FTX completely halted withdrawals. Does the name Celsius ring any bells?

CZ Steps In

At this point, it was clear that FTX was insolvent, and did not have enough funds to recognize customer withdrawals. Shortly after withdrawals were halted, news released that Binance had entered into a non-binding LOI with FTX to acquire the exchange to help with the liquidity crunch. This served as a glimmer of hope for FTX and its users, even though it was relatively clear that Binance would not go through with the acquisition; FTX was rumored to have an $8 billion hole. To no one’s surprise, Binance did not go through with the acquisition, and FTX, FTX US, and Alameda Research ultimately filed for Chapter 11 Bankruptcy.

Fraud

Now, you may be wondering – how did FTX suddenly have such a large financial hole of $8-10 billion in their balance sheet? It was now revealed that FTX had moved user funds and deposits to Alameda Research, as Alameda blew a huge financial hole open on their own balance sheet with losses on their investments and loans made throughout the year (remember that Alameda gave Voyager a loan of around $150 million after the Terra and Celsius crash). In pursuit of cash themselves, Alameda then took a loan from FTX by depositing FTT as collateral to obtain those funds as a loan; FTX was essentially Alameda’s piggy bank. When the bank run on FTX began, FTX did not have sufficient liquidity on hand to honor customer withdrawals, leading to the blow up of the exchange. FTX using customer funds for their own benefit was a breach of terms of service. Coupled with the consistent lies that SBF spewed out all over Twitter regarding their assets and funds, safe to say that he managed to fool the majority of investors and users.

SBF had built up his entire persona of being an effective altruist and key industry figure to gain the industry’s trust – Financial institutions, American regulators, politicians, Tom Brady, Stephen Curry, CT (crypto twitter) traders, and retailers like us all believed him, until we didn’t.

Where Does Crypto Go From Here?

The FTX Saga has definitely shaken up the crypto community, affecting many retailers, whales, and institutions. We expect investor confidence and liquidity in the industry to take a hit, and it will probably take some time for this confidence to build up again. Additionally, there are still many institutions and funds who have yet to disclose how much damage they incurred from the FTX and Alameda collapse. Sequoia, Multicoin, and BlockFi have made statements on the damage done, and we expect to see more of the contagion effect play out over the next few weeks. With that being said, a potential decline in investments in the industry does not mean that projects stop building; we strongly believe that projects and developers will continue to build.

We’ve already seen the rise in popularity for decentralized exchanges and trading, with GMX and Gains Network being the notable projects that have risen to fame in recent months. The case for DeFi and decentralized platforms has only grown stronger. As these DEXs continue to innovate with more product offerings, investors would very likely start to adopt and use these platforms more, potentially bringing the DeFi narrative back to life. Naturally, we would also see an increase in the usage and popularity of self-custody wallets – a vertical that we’ll be keeping an eye on.

The implosion of SBF’s empire has also provided regulators with a great reason to start yelling about regulating the industry again. The regulatory debate is one that sparks conversation within the community; crypto is decentralized so regulation would technically defeat the purpose. To a certain extent, regulation would be needed in order for the industry to mature, but it would require oversight from individuals who are knowledgeable about the space and are regulating with the goal of also helping the space grow and mature. Setting clear guidelines on centralized entities regarding proper financial disclosures and transparency around funds could be a good start.

Ultimately, the market won’t be going anywhere; cleaning out the “dirt” in the industry is healthy.

Additional Content

More detailed timeline with details - 0xkyle

Alameda was apparently insolvent when Terra and 3AC imploded earlier this year - Lucas Nuzzi

The FTT Token mechanism and how it was used as collateral - jonwu.eth

FTX Trading Ltd Balance Sheet - kadhim

SBF’s deleted tweets - TheTieIO

The operations of FTX-Alameda

Meme - A wild Su Zhu appears

Meme - POV: SBF rugs you